Sunday, 30 October 2011

Written by

Sam Chee Kong

Sejak berabad lamanya, emas telah dikenali sebagai satu cara

menonjolkan kekayaan seseorang dan memainkan peranan penting dalam

jual-beli kuasa. Semasa tamadun pemerintahan Mesir dan Yunani lagi, emas

digunakan bukan hanya untuk tujuan kecantikkan, tetapi juga sebagai

cara berjual-beli dan sebagai satu kuasa mengubah nasib seseorang itu.

Namun begitu, apa sahaja yang mempunyai nilai ke atasnya, pasti akan ada

mekanisme jatuh-bangun nilainya.

Sejak berabad lamanya, emas telah dikenali sebagai satu cara

menonjolkan kekayaan seseorang dan memainkan peranan penting dalam

jual-beli kuasa. Semasa tamadun pemerintahan Mesir dan Yunani lagi, emas

digunakan bukan hanya untuk tujuan kecantikkan, tetapi juga sebagai

cara berjual-beli dan sebagai satu kuasa mengubah nasib seseorang itu.

Namun begitu, apa sahaja yang mempunyai nilai ke atasnya, pasti akan ada

mekanisme jatuh-bangun nilainya.Pasaran emas dilihat stabil baru-baru ini sejak diniagakan pada bulan Ogos iaitu setinggi $1927 dan serendah $1529 pada 16 September lalu. Kemeruapan petunjuk VIX dikatakan sebagai punca penstabilan hasil bumi itu. Di dalam artikel terdahulu kami, kami ada menyarankan penjualan di bulan Ogos selepas sedikit gencatan di dalam harga Emas. Jadi ke mana kita sekarang?

Mengambil kedua-dua pandangan terkini politik dan ekonomi di serata dunia, kami telah sampai kepada satu rumusan yang masa untuk memberikan keyakinan terhadap Emas sudah menyinar. Masa untuk berkeyakinan pada Emas pada masa ini adalah berasaskan alasan-alasan fundamental dan teknikal.

Secara fundamentalnya, ada banyak sebab kenapa harga Emas akan melonjak naik.

Friday, 21 October 2011

Bukti Kuasa Beli Emas (Dinar) & Perak (Dirham) kalis inflasi dari Al-Quran dan Hadis Posted by admin

Salam sejahtera pembaca sekalian,

Alhamdulillah syukur kepada Allah SWT kerana kita telah di panjangkan usia dan diperkenankan olehNya untuk menimba satu lagi ilmu pengetahuan yang baru dalam mendekatkan diri kita denganNya.

Di dalam saya membuat kajian tentang kelebihan emas dan perak, terdetik di dalam diri saya, apa jua yang berlaku di dalam kehidupan manusia baik dari segi hukum agama serta muamalah semestinya telah diceritakan di dalam Al-Quran dan hadis.

Alhamdulillah syukur kepada Allah SWT kerana kita telah di panjangkan usia dan diperkenankan olehNya untuk menimba satu lagi ilmu pengetahuan yang baru dalam mendekatkan diri kita denganNya.

Di dalam saya membuat kajian tentang kelebihan emas dan perak, terdetik di dalam diri saya, apa jua yang berlaku di dalam kehidupan manusia baik dari segi hukum agama serta muamalah semestinya telah diceritakan di dalam Al-Quran dan hadis.

Salah satu mukjizat Rasulullah SAW adalah Al-Quran

MINGGU ini saya bercerita sedikit tentang emas sebagai pelaburan.

Sebenarnya emas sudah menjadi bahan pelaburan sejak harganya mula-mula

diselaraskan pada tahun 1717 oleh Sir Isaac Newton.

Pada tahun 1971, emas tidak lagi terikat dengan Dolar Amerika dan diperdagangkan secara bebas. Pada 6 Oktober 2009 baru-baru ini, harga emas di pasaran emas dunia melonjak sebanyak AS$24.60 kepada AS$1,041.80 seauns sehari.

Pada tahun 1971, emas tidak lagi terikat dengan Dolar Amerika dan diperdagangkan secara bebas. Pada 6 Oktober 2009 baru-baru ini, harga emas di pasaran emas dunia melonjak sebanyak AS$24.60 kepada AS$1,041.80 seauns sehari.

1. Melabur di dalam saham

2. Melabur di dalam hartanah

3. Menambahkan ilmu

4. Menjual barangan yang anda tidak perlukan lagi

5. Mendapatkan kerja sambilan

6. Menyewakan bilik yang tidak digunakan

7. Memulakan perniagaan

8. Menyertai syarikat jualan langsung (Multi Level Marketing)

9. Balajar bagaimana untuk menjual

10. menjana wang di Internet

11. Dapatkan kenaikan gaji atau pekerjaan kedua

12. Mengubah cara anda berfikir

13. Meningkatkan nilai anda

14. Dapatkan kerja tambahan

15. Dapatkan wang daripada badan kebajikan atau badan-badan bantuan jika anda layak

16. Memasuki kelas untuk mempalajari kemahiran tambahan

17. Beli syarikat kecil yang sudah kukuh dan berjaya

18. Mulakan blog "menjana wang" di Internet

19. Melabur dalam komoditi

20. Jadikan syarikat anda syarikat awam

21. Kurangkan membayar cukai

22. Mempelajari dagangan mata wang asing (FOREX) - perlu banyak kajian

23. Melabur dalam unit amanah

24. Dapatkan tajaan atau bantuan daripada ahli keluarga, jika anda berani

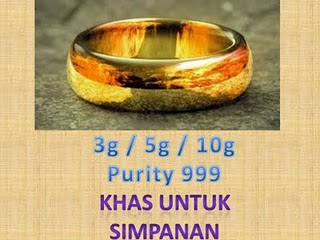

25. MULA MEMBELI EMAS SEBAGAI PELABURAN & SIMPANAN JANGKA PANJANG

2. Melabur di dalam hartanah

3. Menambahkan ilmu

4. Menjual barangan yang anda tidak perlukan lagi

5. Mendapatkan kerja sambilan

6. Menyewakan bilik yang tidak digunakan

7. Memulakan perniagaan

8. Menyertai syarikat jualan langsung (Multi Level Marketing)

9. Balajar bagaimana untuk menjual

10. menjana wang di Internet

11. Dapatkan kenaikan gaji atau pekerjaan kedua

12. Mengubah cara anda berfikir

13. Meningkatkan nilai anda

14. Dapatkan kerja tambahan

15. Dapatkan wang daripada badan kebajikan atau badan-badan bantuan jika anda layak

16. Memasuki kelas untuk mempalajari kemahiran tambahan

17. Beli syarikat kecil yang sudah kukuh dan berjaya

18. Mulakan blog "menjana wang" di Internet

19. Melabur dalam komoditi

20. Jadikan syarikat anda syarikat awam

21. Kurangkan membayar cukai

22. Mempelajari dagangan mata wang asing (FOREX) - perlu banyak kajian

23. Melabur dalam unit amanah

24. Dapatkan tajaan atau bantuan daripada ahli keluarga, jika anda berani

25. MULA MEMBELI EMAS SEBAGAI PELABURAN & SIMPANAN JANGKA PANJANG

Today's inflation figure stands at 0.5 percent. And, although there was negative inflation in June, the 12-month figures are all alarmingly high, topping out at 3.6 percent.

Does that mean it's really and finally back, for sure? We're afraid so.

The Fed has one time-tested way of doing this, which is to strip out food and energy prices: if you do that, inflation was just 0.2% last month, and 1.8% over the past year. Meanwhile, energy costs have gone haywire:

Macam mana nak kenal aset dan macam mana nak kenal liabiliti. Tahukah

anda apabila kita dapat mengenal pasti dan memahami apa itu aset dan

apa itu liabiliti, maka kita berpeluang mencapai "tahap menghampiri

jutawan". Ini kerana 99% manusia di dunia ini telah membazirkan usia

mereka dengan membeli liabiliti. Hanya 1% manusia sahaja yang

betul-betul membeli aset dalam hidup mereka. Dan golongan 1% ni

benar-benar memahami apa yang dikatakan aset dan apa yang dikatakan

liabiliti.

Sunday, 25 September 2011

September 24, 2011

The drop in gold price was the worst since the 2008 banking crisis. — Reuters pic

Written by Lim Siew May of theedgemalaysia.com

KUALA LUMPUR: Gold’s reign as a safe haven investment is strengthening. The price of the precious metal has almost doubled within a year — it was traded at only US$1,192.51 (RM3,584.69) an ounce a year ago and hit a high of US$1,800 an ounce on Aug 11.

As an investment, gold is held mainly for capital appreciation. But its popularity and security has prompted lenders to create a new mode of financing. Islamic pawnbroking schemes offered by Bank Rakyat and Agrobank allow borrowers to use gold coins or jewellery as collateral. Designed to adhere to Islamic laws, borrowers pay a safe-keeping fee, as opposed to a compounding interest rate.

Friday, 23 September 2011

A recently released WikiLeaks cable shows

that China is converting much of its foreign holdings in gold; far away

from the U.S. dollar.

A majority of China's gold reserves are located here in the U.S and in some European countries.

While the U.S. and Europe have an

alternative agenda to dissuade people from viewing gold as an

international reserve currency, China's upping their ante. In doing so,

China aims to push other countries towards reserving in more and more in

gold; leaving the U.S dollar by the wayside.

1) Economy

The U.S. manufacturing base has been shipped overseas. The few jobs being created are in the service industry or government sector. The official unemployment rate hovers near 10%, and 1 out of every 8 Americans is on food stamps. The 2008 economic implosion destroyed the real estate market, sent foreclosures skyrocketing, and swallowed up a nearly $1 trillion bailout... and yet, most experts predict the worst is still to come.

The U.S. manufacturing base has been shipped overseas. The few jobs being created are in the service industry or government sector. The official unemployment rate hovers near 10%, and 1 out of every 8 Americans is on food stamps. The 2008 economic implosion destroyed the real estate market, sent foreclosures skyrocketing, and swallowed up a nearly $1 trillion bailout... and yet, most experts predict the worst is still to come.

Wednesday, 14 September 2011

DEFINASI ZAKAT

Dari segi bahasa:

Kebersihan, kesucian dan memperbaiki

Kesuburan dan pertambahan

Dari segi istilah syara’ :

Mengeluarkan sebahagian dari harta tertentu untuk diberikan kepada orang-orang yang berhak menerimanya apabila telah memenuhi syarat-syarat yang ditetapkan.

Dari segi bahasa:

Kebersihan, kesucian dan memperbaiki

Kesuburan dan pertambahan

Dari segi istilah syara’ :

Mengeluarkan sebahagian dari harta tertentu untuk diberikan kepada orang-orang yang berhak menerimanya apabila telah memenuhi syarat-syarat yang ditetapkan.

Monday, 12 September 2011

LONDON (Reuters) - The euro and

growth-linked currencies may fall on Monday, hit by a lack of concrete

measures from Group of Seven finance chiefs to address either faltering

growth, the escalating euro zone debt crisis, or exchange rate

volatility.

The dollar, yen and, to a lesser

extent, Swiss franc are set to advance with more investors seeking

safe-haven currencies on the back of rising financial market stress.

That will raise the risk of more solo intervention from Japanese and Swiss authorities.

The flight to safety should drive

core government bonds like German Bunds and British gilts higher,

leading to wider spreads over euro zone peripheral debt, while European

banking shares may ease on mounting worries about contagion engulfing

bigger economies like Italy and Spain.

Finance ministers and central

bankers from the Group of Seven industrialized nations pledged to

respond in a concerted matter to a global slowdown. However, they

offered no specific steps and differed in emphasis on Europe's debt

crisis.

Hedge funds run by Orix Investment

Corp., Superfund and Four Elements Capital Management Pte

benefited from the surge in gold last month, weathering the U.S.

sovereign downgrade and Europe’s deepening debt crisis.

The Orix Commodities Fund, which uses computer programs to search for price signals in futures markets, gained 3.5 percent in August, while Superfund Blue Gold, which invests in global equities and tracks the bullion price, jumped 13.45 percent, the firms said. Gold investments in the Earth Element Fund, run by former commodity traders at BNP Paribas (BNP) and JPMorgan Chase & Co. (JPM), returned 1 percent, helping trim losses in the fund.

Gold surpassed $1,900 an ounce for the first time in August as investors sought protection for their wealth on concerns that global economic growth is slowing. The Eurekahedge Hedge Fund Index lost 1.9 percent in August and the MSCI World Index slid 7.3 percent, their worst month since May 2010.

“Gold has become a very volatile asset class so if you’re good at trading through the volatility you can profit from it,” said Peter Douglas, principal of Singapore-based GFIA Pte, which advises investors seeking to allocate money to hedge funds and runs a wealth-management business.

The Orix Commodities Fund, which uses computer programs to search for price signals in futures markets, gained 3.5 percent in August, while Superfund Blue Gold, which invests in global equities and tracks the bullion price, jumped 13.45 percent, the firms said. Gold investments in the Earth Element Fund, run by former commodity traders at BNP Paribas (BNP) and JPMorgan Chase & Co. (JPM), returned 1 percent, helping trim losses in the fund.

Gold surpassed $1,900 an ounce for the first time in August as investors sought protection for their wealth on concerns that global economic growth is slowing. The Eurekahedge Hedge Fund Index lost 1.9 percent in August and the MSCI World Index slid 7.3 percent, their worst month since May 2010.

“Gold has become a very volatile asset class so if you’re good at trading through the volatility you can profit from it,” said Peter Douglas, principal of Singapore-based GFIA Pte, which advises investors seeking to allocate money to hedge funds and runs a wealth-management business.

(Reuters) - The global economic slowdown has brought emerging Asia's rate-hiking cycle to a premature pause and the next step could be easing if the United States slides into a recession or Europe's debt troubles spawn a full-blown financial crisis.

Central banks in Indonesia, Malaysia and the Philippines said on Thursday that inflation pressures were abating, and predicted they will get more relief as the weakening world economy chills demand.

This is not a sure bet. It assumes that a large portion of the price pressure emanates from abroad rather than from domestic demand, which may not be the case in countries such as China where growth remains strong.

But a look back at the 2008 financial crisis shows that many Asian countries are in a better position to respond to another downward spiral now should the need arise.

Even though inflation is running too hot for comfort across the region, it is lower now than it was in 2008 for some economies, including Indonesia and the Philippines.

(Reuters) - Gold demand, which dropped in the second quarter of this year, is expected to strengthen by the end of 2011, driven by robust jewellery buying in India and China and recovery in investment demand, senior World Gold Council (WGC) officials said.

Overall gold demand fell 17 percent year-on-year in the three months from April to June to 919.8 tonnes, hammered by a sharp drop in investment demand which offset a tentative recovery in jewellery buying, the gold mining industry-funded WGC said in August.

Sunday, 11 September 2011

Posted by Wealth Wire - Friday, September 2nd, 2011

Gold is for wealth preservation and silver is for bartering. If we are talking about protecting wealth in the amount of several million dollars then a good spread to own in precious metals would be 80% gold and 20% silver. If we are talking about a “Mad Max” scenario where we are trying to set ourselves up for a black market bartering system then a good spread would be 75% silver and 25% gold. I will leave it to you to determine what would be an appropriate ratio for you based on the assets you are trying to protect.

Gold is for wealth preservation and silver is for bartering. If we are talking about protecting wealth in the amount of several million dollars then a good spread to own in precious metals would be 80% gold and 20% silver. If we are talking about a “Mad Max” scenario where we are trying to set ourselves up for a black market bartering system then a good spread would be 75% silver and 25% gold. I will leave it to you to determine what would be an appropriate ratio for you based on the assets you are trying to protect.

Posted by Brittany Stepniak - Thursday, September 8th, 2011

It's wedding season in India and nothing says "I love you" like a beautifully, ornate golden necklace or a shiny block of solid investment.

The demand for these physical gold commodities are sky-rocketing as gold prices dipped yesterday after setting another new all-time record high earlier this week.

It's wedding season in India and nothing says "I love you" like a beautifully, ornate golden necklace or a shiny block of solid investment.

The demand for these physical gold commodities are sky-rocketing as gold prices dipped yesterday after setting another new all-time record high earlier this week.

On Tuesday September 6, 2011, 10:07 am EDT

Gold is up 1.7%, or $32, to $1,909 an ounce after the Swiss National Bank capped the Swiss franc exchange rate with the euro at 1.20. Investors are also pouring into the alternative currency as Eurozone markets fell hard yesterday and U.S. markets are opening down over 2%. Italy tumbled 5.3%, Germany fell 5.5% and France dropped 4.9%.

Investing Insights: Will Gold Become Collateral for a Euro Zone Bailout?

Relatedly, Wall St. Cheat Sheet Chief Commodities Analyst Eric McWhinnie examined a new Wikileaks release revealing the thought process behind gold and fiat currencies such as the U.S. Dollar and Euro . The new release says, “China increases it gold reserves in order to kill two birds with one stone. The China Radio International sponsored newspaper World News Journal (Shijie Xinwenbao)(04/28):

SINGAPORE: The global economic slowdown has brought emerging Asia's rate-hiking cycle to a premature pause and the next step could be easing if the United States slides into a recession or Europe's debt troubles spawn a full-blown financial crisis.

Central banks in Indonesia, Malaysia and the Philippines said on Thursday that inflation pressures were abating, and predicted they will get more relief as the weakening world economy chills demand.

This is not a sure bet. It assumes that a large portion of the price pressure emanates from abroad rather than from domestic demand, which may not be the case in countries such as China where growth remains strong.

By RACHEL LOUISE ENSIGN

As

the dollar continues its fall against other world currencies, it makes

imports and foreign travel more expensive for Americans. But some

investors have cashed in on the trend -- by investing in mutual funds

and ETFs that trade in currencies.

Currency exchange-traded funds and mutual funds -- all of which bet on the dollar's movement against one or more currencies -- are growing quickly, though still a niche product. In the first seven months of the year, they took in nearly $2.8 billion in new cash from investors, sending their assets up 37% from the year before, according to Morningstar Inc.

Most of these funds bet against the dollar, which fell 6.2% this year, through August, against a broad basket of currencies including the euro, the Japanese yen and the Swiss franc.

Currency exchange-traded funds and mutual funds -- all of which bet on the dollar's movement against one or more currencies -- are growing quickly, though still a niche product. In the first seven months of the year, they took in nearly $2.8 billion in new cash from investors, sending their assets up 37% from the year before, according to Morningstar Inc.

Most of these funds bet against the dollar, which fell 6.2% this year, through August, against a broad basket of currencies including the euro, the Japanese yen and the Swiss franc.

"I am sitting inside the truck, watching a screen. The truck reels

the tool back up out of the hole, slowly - more slowly than if you were

reeling it in by hand - and foot by foot, the tool passes through all

that dark mystery of time, emitting signals and picking up signals. I

watch the tool's response to the formations it passes through on my

screen, little green blips of radioactivity, and like an EKG, each blip

indicates something...

By Renisha Chainani

Gold keeps finding new catalysts to rise and hit record highs every time. On 2nd August, despite news reports showing Republicans and Democrats are on the verge of resolving the debt-ceiling issue, it rose to view records of $1660.

Many of us anticipated a temporary correction lower in Gold when the deficit-ceiling impasse ended, because Gold had ran up roughly 10% from 1st July to entire month, a period when the debt-ceiling gridlock and potential for a default increasingly dominated headlines.

Gold keeps finding new catalysts to rise and hit record highs every time. On 2nd August, despite news reports showing Republicans and Democrats are on the verge of resolving the debt-ceiling issue, it rose to view records of $1660.

Many of us anticipated a temporary correction lower in Gold when the deficit-ceiling impasse ended, because Gold had ran up roughly 10% from 1st July to entire month, a period when the debt-ceiling gridlock and potential for a default increasingly dominated headlines.

Commodity Online

Price forecast: Q3 11: $1725/oz; Q4 11: $1875/oz; 2012 annual average: $2000/oz

Gold prices tested fresh all-time intraday highs before dipping below $1800/oz this week; however the macro environment has become increasingly Gold favourable with central banks keeping interest rates unchanged, the SNB's (Swiss National Bank’s) decision to limit the strength of the CHF and continued uncertainty surrounding the state of the global economy. Good physical demand has emerged from price dips, and other central banks have announced they will add to their gold reserves. In turn, barring short-term corrections, we remain positive on gold.

Price forecast: Q3 11: $1725/oz; Q4 11: $1875/oz; 2012 annual average: $2000/oz

Gold prices tested fresh all-time intraday highs before dipping below $1800/oz this week; however the macro environment has become increasingly Gold favourable with central banks keeping interest rates unchanged, the SNB's (Swiss National Bank’s) decision to limit the strength of the CHF and continued uncertainty surrounding the state of the global economy. Good physical demand has emerged from price dips, and other central banks have announced they will add to their gold reserves. In turn, barring short-term corrections, we remain positive on gold.

By Jo Winterbottom

NEW DELHI |

Sat Sep 10, 2011 9:21pm IST

(Reuters) - In a nation whose love for gold is legendary, financial adviser Biju Daniel is one of scores of Indians who are rethinking how they amass riches through the precious metal.

Daniel's wife owns at least a kilogram of jewellery and he sports a gold watch. But he is also shrewd enough to realise that the world's biggest gold consumers are falling out of love with wearing their wealth, preferring to stock up on coins, bars and bullion-based investment funds as they look for returns safe from the ravages of inflation and the dictates of fashion.

Last updated on 8 September 2011 - 07:32pm

LONDON (Sept 8, 2011): Gold bounced back on Thursday as the previous session's dramatic 3% price slide tempted physical bullion buyers back to the market, with concerns over euro zone debt and the US economy firmly underpinning interest.

Financial markets are keenly awaiting key speeches on the US economy from President Barack Obama and Federal Reserve chairman Ben Bernanke later, and the outcome of the latest policy meeting of the European Central Bank (ECB).

LONDON (Sept 8, 2011): Gold bounced back on Thursday as the previous session's dramatic 3% price slide tempted physical bullion buyers back to the market, with concerns over euro zone debt and the US economy firmly underpinning interest.

Financial markets are keenly awaiting key speeches on the US economy from President Barack Obama and Federal Reserve chairman Ben Bernanke later, and the outcome of the latest policy meeting of the European Central Bank (ECB).

Wednesday, 7 September 2011

Emas dan perak adalah merupakan logam galian yang berharga kurniaan

Allah SWT. Ia merupakan hasil bumi yang banyak manfaat kepada manusia

dan manusia pula menjadikannya nilai tukaran wang bagi segala sesuatu.

Sementara syariat pula mengibaratkan emas dan perak sebagai sesuatu

kekayaan alam yang hidup dan berkembang. Syariat juga telah mewajibkan

kedua-duanya boleh digunakan dalam bentuk wang atau kepingan, bekas

bejana, cenderahati, ukiran atau perhiasan.

Monday, 5 September 2011

Perkataan karat diambil dari perkataan Latin iaitu kerátion (??????o?), atau dari perkataan Arab q?r?? (?????) dan juga dari perkataan Itali carato, yang bermaksud Biji Kacang Carob, Pada waktu dulu sebelum timbangan gram, oz atau mana2 berat standard digunakan, orang-orang tua kita menggunakan biji kacang carob (dikhabarkan setiap bijinya adalah sama walau dimana ia tumbuh) sebagai timbangan berat. Mengikut persamaan , 1 karat adalah bersamaan dengan 24 (berat emas)/(berat total item).

Mengikut pengetahuan hari ini taburan penemuan emas utama di Semenanjung Tanah Melayu terdapat di Jalur Tengah, iaitu dari Batu Melintang di Kelantan, menuju ke selatan melalui Sokor, Pulai, Selinsing, Raub, Chenderas hinggalah ke Gunung Ledang di Johor. Jumpaan terbaru dibuat di Jalur Timur iaitu di kawasan Mersing di Johor dan Lubuk Mandi di Terengganu.

Perlombongan emas di Malaysia hanya terhad di beberapa kawasan sahaja, ia dikenali sebagai Jalur Tengah yang terbentang dari kawasan tanah tinggi Batu Melintang, Jeli, Kelantan, sehingga Gunung Ledang di Johor. Lombong terbesar yang masih aktif di Malaysia adalah di Penjam,kuala lipis, ia mengeluarkan hampir 95% pengeluaran emas Malaysia. Tempat lain yang masih aktif adalah di Kuala Selinsing, Damar Reef dan Tersang di Pahang . Selain itu masih ada 5 lagi lombong di Jeli dan 6 lombong sekitar kawasan raub, kuala lipis di Pahang masih digali untuk aktiviti perlombongan komersial.

The golden constant

Since the 14th Century, gold’s purchasing power has maintained a broadly

constant level.To put this in practical terms, an ounce of gold has repeatedly

bought a mid-range outfit of clothing.This was true in the fourteenth century,

when an ounce of gold was worth £1.25 to £1.33;it was true in the late 18th

century and it remained true at the beginning of this century (2000 to 2008),

when an ounce of gold averaged £269 or $472. Even the exchange rate

between gold and commoditieshas been relatively constant over the centuries.

On the other hand, the US dollar that bought 14.5 loaves of bread in 1900 buys

only 3/4 of a loaf today.While inflation and other forces have ravaged the value

of the world’s currencies, gold has emerged with its capacity for wealth

preservation firmly intact. Being no-one’s liability, gold exhibits the same wealth

preserving qualities in the face of financial turmoil, earning a reputation as a

crisis hedge in addition to its credentials as an inflation hedge.

only 3/4 of a loaf today.While inflation and other forces have ravaged the value

of the world’s currencies, gold has emerged with its capacity for wealth

preservation firmly intact. Being no-one’s liability, gold exhibits the same wealth

preserving qualities in the face of financial turmoil, earning a reputation as a

crisis hedge in addition to its credentials as an inflation hedge.

The Golden Constant: The English and American Experience 1560-2007

by Roy W Jastram with updated material by Jill Leyland.

Published 2009 by Edward Elgar Publishing Ltd

(www.e-elgar.com), hardback, 368 pages, ISBN: 978 1 84720 261 1.

by Roy W Jastram with updated material by Jill Leyland.

Published 2009 by Edward Elgar Publishing Ltd

(www.e-elgar.com), hardback, 368 pages, ISBN: 978 1 84720 261 1.

Sunday, 4 September 2011

MANILA, Philippines - Conglomerate First Pacific Co. Ltd. is

looking to acquire gold and coal assets in Indonesia, managing director

and chief executive officer Manuel V. Pangilinan said last week.

The move comes more than a year after First Pacific effectively gained control of Philex Mining Corp., the Philippines’ biggest gold producer. If successful, it could also be First Pacific’s next major acquisition outside the Philippines.

The move comes more than a year after First Pacific effectively gained control of Philex Mining Corp., the Philippines’ biggest gold producer. If successful, it could also be First Pacific’s next major acquisition outside the Philippines.

* Spot gold pulls back from record high; buying robust

* India yet to make bulk purchase for wedding season

By Rujun Shen

SINGAPORE, Aug 24 (Reuters) - Gold buyers rushed into Asia's

physical market on Wednesday, after prices retreated from the

record high hit in the previous session, as investors maintained

interest in bullion due to a shaky global growth outlook.

Reuters Aug 31, 2011, 01.30pm IST

Tags:

SINGAPORE:

Gold premiums in Singapore and Hong Kong rose on growing appetite for

physical gold from Asia's investors, after prices fell off a record

above $1,900 hit last week.

An upcoming festival and wedding season in India and a week-long holiday in early October in China are expected to help boost gold appetite.

"Prices came down from the peak last week -- this is the main cause behind the buying," said a Singapore-based trader, adding that most buying came from households seeking to use gold to hedge against inflation and economic uncertainties rather than jewellers.

An upcoming festival and wedding season in India and a week-long holiday in early October in China are expected to help boost gold appetite.

"Prices came down from the peak last week -- this is the main cause behind the buying," said a Singapore-based trader, adding that most buying came from households seeking to use gold to hedge against inflation and economic uncertainties rather than jewellers.

By SARAH DILORENZO

NEW YORK - For what is normally a sleepy month, there are so many customers at the Gold Standard, a New York company that buys jewelry, that it feels like Christmas in August. Uncle Ben's Pawn Shop in Cleveland has never seen a rush like this.

Welcome to the new American gold rush. The price of gold is on a remarkable run, setting a record seemingly every other day. Stomach- churning volatility in the stock market this month has only made investors covet gold more.

NEW YORK - For what is normally a sleepy month, there are so many customers at the Gold Standard, a New York company that buys jewelry, that it feels like Christmas in August. Uncle Ben's Pawn Shop in Cleveland has never seen a rush like this.

Welcome to the new American gold rush. The price of gold is on a remarkable run, setting a record seemingly every other day. Stomach- churning volatility in the stock market this month has only made investors covet gold more.

Saturday, 3 September 2011

LONDON, Sept 2 — Europe’s most indebted nations are under heavy

pressure from their richer neighbours to sort out their finances, but

they are unlikely to mimic the impoverished gentlefolk of old by selling

off the family silver — or in their case, gold — to do so.

More than 750 tonnes of gold are currently sitting in the state coffers of Portugal, Greece and Spain alone, equal to about 17 per cent of the 2010 annual supply of bullion from mining and sales of scrap.

Despite struggling with massive debt burdens and in some cases accepting multi-billion-euro bailout packages, the so-called PIIGS — the countries above, plus Ireland and Italy — have not dipped into their gold reserves to service that debt.

More than 750 tonnes of gold are currently sitting in the state coffers of Portugal, Greece and Spain alone, equal to about 17 per cent of the 2010 annual supply of bullion from mining and sales of scrap.

Despite struggling with massive debt burdens and in some cases accepting multi-billion-euro bailout packages, the so-called PIIGS — the countries above, plus Ireland and Italy — have not dipped into their gold reserves to service that debt.

Thursday, 1 September 2011

osted by Andrew Mickey - Tuesday, August 30th, 2011

But gold investors shouldn’t be too concerned about the short-term swings of the volatile gold market...

They should be focused on what’s really going on in the financial world — and how it will propel gold to currently unthinkable levels.

Gold's incredible run has been a bit too far too fast for most investors.

Gold is up 54% in the past year.

That’s a big gain in any market. And from what recent history has taught most investors, that’s too far, too fast.

That's what I wrote last week...Gold prices fell about 10% in the next 48 hours.But gold investors shouldn’t be too concerned about the short-term swings of the volatile gold market...

They should be focused on what’s really going on in the financial world — and how it will propel gold to currently unthinkable levels.

You're now thinking about gold.

We all are. (It's up $46 today).

And if you don't already own some — with global forecasts worsening by the day — you're seriously

contemplating it.

Or at least, you should be...

Something changes inside a person when they

feel the weight of that first bar or bars in their hand. It's not the

shininess or surprising density; it's a feeling of security that washes

over you as you hold — in your own palm — a building block of

civilization.

It's magical.

By Luke Burgess and Adam Sharp

The Gold-Silver Ratio

If you average out the price ratio between gold and silver (how many ounces of silver an ounce of gold will buy) throughout history, you land on a single magical proportion: 16 to 1. This chart is slightly outdated, but gets the point across nicely.

And even experts who do not subscribe to fixed pricing relationships generally agree that a price ratio of 20 to 1 should be considered normal.

The Gold-Silver Ratio

If you average out the price ratio between gold and silver (how many ounces of silver an ounce of gold will buy) throughout history, you land on a single magical proportion: 16 to 1. This chart is slightly outdated, but gets the point across nicely.

And even experts who do not subscribe to fixed pricing relationships generally agree that a price ratio of 20 to 1 should be considered normal.

Posted by Ian Cooper - Thursday, December 16th, 2010

From Mineweb.com:

"While recent statistics show that China's gold imports have risen dramatically this year, despite China itself being the world's largest gold producer with mine production still rising to, anecdotal evidence suggests that this may just be the tip of the iceberg as Chinese people are, apparently, rushing to buy gold as an inflation hedge.

From Mineweb.com:

"While recent statistics show that China's gold imports have risen dramatically this year, despite China itself being the world's largest gold producer with mine production still rising to, anecdotal evidence suggests that this may just be the tip of the iceberg as Chinese people are, apparently, rushing to buy gold as an inflation hedge.

Posted by Adam Sharp - Tuesday, July 5th, 2011

Gold vending machine operator Gold-to-Go has installed its first machine in London.

From The Telegraph:

Gold vending machine operator Gold-to-Go has installed its first machine in London.

From The Telegraph:

The company behind the gold bar vending machines plans to install 50 across Britain over the next few years, allowing ordinary shoppers to invest in the precious metal as an investment.

Wealth Wire - Tuesday, August 30th, 2011

The dollar gold bullion price leapt 2.2% in less than an hour Tuesday lunchtime London time, hitting $1832 per ounce – still 4.2% off last week's all-time high – while commodities fell, US Treasury bonds rose and stocks were mixed as Greek debt worries affected the Eurozone.

"Conventional wisdom is that bullish sentiment on equities would mean bearish sentiment on gold," reckons one gold bullion dealer here in London.

The dollar gold bullion price leapt 2.2% in less than an hour Tuesday lunchtime London time, hitting $1832 per ounce – still 4.2% off last week's all-time high – while commodities fell, US Treasury bonds rose and stocks were mixed as Greek debt worries affected the Eurozone.

"Conventional wisdom is that bullish sentiment on equities would mean bearish sentiment on gold," reckons one gold bullion dealer here in London.

Posted by Brittany Stepniak - Wednesday, August 31st, 2011

Gold switched back and forth between gains and losses today as U.S. stocks climbed for a fourth day.

On the Comex division of the New York Mercantile Exchange, gold just recently traded at $1,833.10 per ounce, gaining 0.2 percent, up $3.60.

Overall, gold has gained approximately 12 percent in the month of August and 30 percent over the course of the year. And analysts say the $1800-mark is a psychologically important number, showing investors still have serious doubts about a rebounding stock market.

Gold switched back and forth between gains and losses today as U.S. stocks climbed for a fourth day.

On the Comex division of the New York Mercantile Exchange, gold just recently traded at $1,833.10 per ounce, gaining 0.2 percent, up $3.60.

Overall, gold has gained approximately 12 percent in the month of August and 30 percent over the course of the year. And analysts say the $1800-mark is a psychologically important number, showing investors still have serious doubts about a rebounding stock market.

Monday, 29 August 2011

To all our friends, colleagues and acquaintances,to our blogger friends and lovely readers, facebookers and twitters, we would like to take this opportunity to wish all of you

To all our friends, colleagues and acquaintances,to our blogger friends and lovely readers, facebookers and twitters, we would like to take this opportunity to wish all of you

Selamat Hari Raya Aidilfitri & Maaf Zahir dan Batin.

Thanks you for all the supports you have given to us throughout the years and we hope to be the your best service all times.Fauzi & Zira Zairien

Sunday, 28 August 2011

Market analysts suggest that holders of physical gold control the market.

Whether it is gold bars or coins, whoever

actually owns those pieces of gold are the investors who drive the

market according to Julian Phillips from The Gold Forecaster.

Yes, there are many ways to invest in

gold and a plenty of reasons to do so, but most investors never actually

own gold per se, but instead buy options or stocks.

Gold is officially the most desirable precious metal, asset, and

safe-haven in these tough economic times, and seasons of political

unrest.

According to the Aug. 11-14 Gallup poll, 34 percent of Americans choose gold as the best investment option. Real estate is in second place, then stocks/mutual funds, followed by savings accounts and CDs, with bonds as the fourth top-rated investment.

According to the Aug. 11-14 Gallup poll, 34 percent of Americans choose gold as the best investment option. Real estate is in second place, then stocks/mutual funds, followed by savings accounts and CDs, with bonds as the fourth top-rated investment.

Friday, 19 August 2011

By Tony Daltorio

Investors are well aware of many of the reasons for having gold as part of their portfolio. Lately, these reasons have swirled around macroeconomic concerns -- the U.S. debt rating downgrade , possible sovereign defaults in the eurozone and the possibility of more money printing from the Federal Reserve via a third round of quantitative easing.

Investors are well aware of many of the reasons for having gold as part of their portfolio. Lately, these reasons have swirled around macroeconomic concerns -- the U.S. debt rating downgrade , possible sovereign defaults in the eurozone and the possibility of more money printing from the Federal Reserve via a third round of quantitative easing.

Venezuela holds almost 60% of its physical gold reserves in the US, Canada, England and Switerland. Now in an effort to diverisfy its holdings away from US and European financial institutions, Chavez wants to repatriate the precious metal.

“We’ve held 99 tons of gold at the Bank of England since 1980. I agree with bringing that home,” Chavez said yesterday on state television. “It’s a healthy decision.”1

Wednesday, 17 August 2011

(Reuters) - With gold prices up nearly 16 percent to record highs since Standard & Poor's downgraded U.S. credit, and growing fears of a double-dip recession, the precious metal could go on to hit $3,000 an ounce within 2-3 years, said a portfolio manager at AGF Precious Metals Fund.

It's been exactly 40 years since Nixon abandoned the gold standard, making your money only as valuable as the hope

behind it.![nixon gold nixon gold]()

While that single pen stroke was a death blow for the dollar — and has led us down a path of fiscal ruin

culminating in the downgrading of our debt — one fact remains clear...

Tuesday, 16 August 2011

Mengetahui sebab-sebab dan kesan-kesan inflasi dan belajar bagaimana mengatasinya.

Kira-kira 30 tahun yang lalu, sepinggan nasi lemak berharga kurang daripada RM1. Hari ini, ia telah naik sehingga RM5, jadi jangan terkejut untuk membayar lebih dari RM10 untuk sarapan pagi anda dalam dekad yang akan datang!

Kira-kira 30 tahun yang lalu, sepinggan nasi lemak berharga kurang daripada RM1. Hari ini, ia telah naik sehingga RM5, jadi jangan terkejut untuk membayar lebih dari RM10 untuk sarapan pagi anda dalam dekad yang akan datang!

Friday, 12 August 2011

Dear BullionVault client,

I don't want to be a nuisance but you might like to know about this. My apologies if you don't.

BullionVault is one of the fastest growing businesses on the web. You can participate and earn a no-nonsense 25% share of our gross commission by introducing gold and BullionVault.com to your own website's visitors.

It takes two minutes to set up using this simple link: http://www.bullionvault.com/#

You can learn more here in our help pages here.

I don't want to be a nuisance but you might like to know about this. My apologies if you don't.

BullionVault is one of the fastest growing businesses on the web. You can participate and earn a no-nonsense 25% share of our gross commission by introducing gold and BullionVault.com to your own website's visitors.

It takes two minutes to set up using this simple link: http://www.bullionvault.com/#

You can learn more here in our help pages here.

J.P. Morgan Chase & Co. (JPM) said they see gold prices steadily

climbing over $2,000 this year, reaching $2,500 by the year's end.

We haven't seen a gold-trend like this since the 1970s, peaking around 1980, but the current global economy could re-create a similar "parabolic" pattern for gold within the next few months.

We haven't seen a gold-trend like this since the 1970s, peaking around 1980, but the current global economy could re-create a similar "parabolic" pattern for gold within the next few months.

Back in April gold spiked to prices hovering around the $1500 range. At that time, Goldline International Inc. predicted gold would surge to $1700 per ounce by 2015...

Fast foward just about three months later, and we've already hit the spot. Today, Monday, August 8 2011: gold reached $1700, and is properly positioned to hike even further in response to Standard & Poor's slashing of the U.S. credit rating on Friday.

Fast foward just about three months later, and we've already hit the spot. Today, Monday, August 8 2011: gold reached $1700, and is properly positioned to hike even further in response to Standard & Poor's slashing of the U.S. credit rating on Friday.

Gold is huge right now. More valuable than other commodities and

safer than other currencies. It's officially here to stay. And silver's

not far behind...

Prices are falling slightly after surpassing records (remember: buy on dips!) earlier this week. Take a look at the charts. Then read the article to see the growth prospects that lie ahead for these two precious metals.

Prices are falling slightly after surpassing records (remember: buy on dips!) earlier this week. Take a look at the charts. Then read the article to see the growth prospects that lie ahead for these two precious metals.

Wednesday, 3 August 2011

Syukur Allah mengizinkan kita mengecapi nikmat iman dan Islam...

Syukur Allah mengurniakan kita satu bulan yang penuh dengan barokah...

Syukur Allah jadikan padanya satu malam yang lebih baik sari seribu bulan...

Syukur Allah naungi kita dengan rahmat dan hidayahnya...

Syukur Allah pertemukan lagi kita dengan bulan yang mulia ini...RAMADHAN AL MUBARAK.

ALHAMDULILLAH..

Mohamad Fauzi

Hijrah Dinar Admin.

Syukur Allah mengurniakan kita satu bulan yang penuh dengan barokah...

Syukur Allah jadikan padanya satu malam yang lebih baik sari seribu bulan...

Syukur Allah naungi kita dengan rahmat dan hidayahnya...

Syukur Allah pertemukan lagi kita dengan bulan yang mulia ini...RAMADHAN AL MUBARAK.

ALHAMDULILLAH..

Mohamad Fauzi

Hijrah Dinar Admin.

Tuesday, 19 July 2011

Asslamualaikum..

untuk makluman semua saya akan mengadakan satu program/taklimat "RAHSIA KEKUATAN EKONOMI ISLAM" dengan kerjasama Koperasi Pembangunan Kampung Tradisional Guar Perahu Pulau Pinang Berhad.

Tempat : Dewan Koperasi Pembangunan Kampung Tradisional Guar Perahu Pulau Pinang Berhad

Tarikh : 24 Julai 2011 (Ahad)

Masa : 3:00 Petang

Anda semua dijemput dan kedatangan anda amat dialu-alukan.

Sila hubungi En. Zambri (013-433 0458) untuk maklumat lanjut.

Sekian, terimakasih..

Mohamad Fauzi

Hijrah Dinar

untuk makluman semua saya akan mengadakan satu program/taklimat "RAHSIA KEKUATAN EKONOMI ISLAM" dengan kerjasama Koperasi Pembangunan Kampung Tradisional Guar Perahu Pulau Pinang Berhad.

Tempat : Dewan Koperasi Pembangunan Kampung Tradisional Guar Perahu Pulau Pinang Berhad

Tarikh : 24 Julai 2011 (Ahad)

Masa : 3:00 Petang

Anda semua dijemput dan kedatangan anda amat dialu-alukan.

Sila hubungi En. Zambri (013-433 0458) untuk maklumat lanjut.

Sekian, terimakasih..

Mohamad Fauzi

Hijrah Dinar

Thursday, 7 July 2011

Posted by Brittany Stepniak - Tuesday, July 5th, 2011

It's an adventure story worthy of a movie. The only thing that's missing is Indiana Jones.

In Thiruvananthapuram India, locked vaults inside a 16th-century Sree Padmanabhaswamy Temple hold a plethora of riches ranging from gold coins, trinkets, and golden statues, to diamonds and a surplus of precious stone jewels.

It's an adventure story worthy of a movie. The only thing that's missing is Indiana Jones.

In Thiruvananthapuram India, locked vaults inside a 16th-century Sree Padmanabhaswamy Temple hold a plethora of riches ranging from gold coins, trinkets, and golden statues, to diamonds and a surplus of precious stone jewels.

Posted by Brittany Stepniak - Wednesday, July 6th, 2011

The short-term trend for silver has switched back to positive, for now. The metal has outperformed gold in recent trading sessions. So far in July silver has gained $2.22 per ounce. Over the next few weeks, prices are expected to fluctuate between $32.00 and $39.00.

The short-term trend for silver has switched back to positive, for now. The metal has outperformed gold in recent trading sessions. So far in July silver has gained $2.22 per ounce. Over the next few weeks, prices are expected to fluctuate between $32.00 and $39.00.

Saturday, 2 July 2011

By Greg McCoach

Get ready. We are now entering the final stages in the collapse of the U.S. dollar...

And it's not going to be pretty.

The massive increases in money supplies will tank the value of the dollar and erode the very fabric of America's economic security.

As a result, gold and silver prices are will no doubt skyrocket, despite the short-term major volatility we've recently seen.

Get ready. We are now entering the final stages in the collapse of the U.S. dollar...

And it's not going to be pretty.

The massive increases in money supplies will tank the value of the dollar and erode the very fabric of America's economic security.

As a result, gold and silver prices are will no doubt skyrocket, despite the short-term major volatility we've recently seen.

This fascinating graph from The Economist shows a list of countries ordered by the amount of gold they hold on a per-citizen basis.

Published 04/20/2011 - 13:00 *Originally published on StreetAuthority.com and re-published with permission.

By Steven OrlowskiI recently watched the classic man-eating fish movie "Jaws" and the latest action in the precious metals space reminded me of the tagline for the film, "Just when you thought it was safe to go back into the water…"

Is it safe to swim in the water? Or is Jaws still lurking out there, the physical embodiment of a financial world gone lethal? Can gold still protect us?

Wednesday, 29 June 2011

Following four sessions of sizeable losses in value, precious metals

climbed along with crude oil this morning as a vote on the

implementation of required austerity measures neared in Greece. Prime

Minister Papandreou’s proposed 78 billion euro program of spending cuts

and asset sales faces a tough sell but is the prerequisite to the

release of some 12 billion euros in payments coming from the initially

approved bailout package.

New Delhi: Silver prices rose by Rs 510 to Rs

51,160 per kg in futures trading on Wednesday as speculators enlarged

their positions on the back of a firming global trend.

At the Multi Commodity Exchange, silver for delivery in July

rose by Rs 510, or 1.01 per cent, to Rs 51,160 per kg, with a business

turnover of 6,774 lots.

Similarly, the metal for delivery in September moved up by Rs 510, or 0.99 per cent, to Rs 52,072 per kg, with an open interest of 1,632 lots.

Market analysts said fresh buying by speculators in tandem with a firming global trend mainly pushed up silver futures prices.

Meanwhile, silver traded 0.38 per cent higher at USD 34.07 an ounce in the Asian region.

Similarly, the metal for delivery in September moved up by Rs 510, or 0.99 per cent, to Rs 52,072 per kg, with an open interest of 1,632 lots.

Market analysts said fresh buying by speculators in tandem with a firming global trend mainly pushed up silver futures prices.

Meanwhile, silver traded 0.38 per cent higher at USD 34.07 an ounce in the Asian region.

Assalamualaikum...

Saya bagi pihak Hijrah Dinar ingin menghebohkan bahawa Cik Siti Aminah Bt Abdul Muin adalah wakil bagi

Hijrah Dinar bagi Zon Tengah Khususnya kawasan Wilayah Persekutuan / Kuala Lumpur.

Kesempatan ini juga saya ingin mengalu-alukan kedatangan Cik Siti Aminah ke dalam keluarga Hijrah Dinar semoga dengan kedatangan Cik Siti Aminah dapat mengembangkan lagi jenama Hijrah Dinar dalam pemasaran emas ini.

Kepada bakal pelanggan yang berada di sekitar Wilayah Persekutuan / Kuala Lumpur boleh menghubungi Cik Siti Aminah untuk maklumat lanjut dan pembelian dinar emas.

Sekian, Terimakasih..

Saya bagi pihak Hijrah Dinar ingin menghebohkan bahawa Cik Siti Aminah Bt Abdul Muin adalah wakil bagi

Hijrah Dinar bagi Zon Tengah Khususnya kawasan Wilayah Persekutuan / Kuala Lumpur.

Kesempatan ini juga saya ingin mengalu-alukan kedatangan Cik Siti Aminah ke dalam keluarga Hijrah Dinar semoga dengan kedatangan Cik Siti Aminah dapat mengembangkan lagi jenama Hijrah Dinar dalam pemasaran emas ini.

Kepada bakal pelanggan yang berada di sekitar Wilayah Persekutuan / Kuala Lumpur boleh menghubungi Cik Siti Aminah untuk maklumat lanjut dan pembelian dinar emas.

Sekian, Terimakasih..

Sumber: Blog Umaralfateh

Alhamdulillah, bersyukur kepada Allah, yang masih memberikan kesempatan ruang waktu kepada saya untuk terus berkongsi apa-apa yang dirasakan baik berdasarkan neraca iman yang telah Allah berikan, Alhamdulillah.

Alhamdulillah, bersyukur kepada Allah, yang masih memberikan kesempatan ruang waktu kepada saya untuk terus berkongsi apa-apa yang dirasakan baik berdasarkan neraca iman yang telah Allah berikan, Alhamdulillah.

Mengerjakan haji merupakan salah satu daripada Rukun Islam yang lima.

Setiap orang Islam yang mempunyai kemampuan, diwajibkan mengerjakan

haji sekali seumur hidup. Firman Allah Taala :

“Menjadi suatu kewajipan ke atas setiap manusia (orang-orang mukmin) pergi mengerjakan haji ke Baitullah, iaitu bagi mereka yang mempunyai kemampuan. Barangsiapa yang kufur (ingkar), maka ketahuilah bahawa sesungguhnya Allah Maha Kaya (tidak memerlukan sesuatu pun) daripada pihak lain (alam).”

“Menjadi suatu kewajipan ke atas setiap manusia (orang-orang mukmin) pergi mengerjakan haji ke Baitullah, iaitu bagi mereka yang mempunyai kemampuan. Barangsiapa yang kufur (ingkar), maka ketahuilah bahawa sesungguhnya Allah Maha Kaya (tidak memerlukan sesuatu pun) daripada pihak lain (alam).”

Assalamualaikum kepada semua para pembaca,

Baru-baru ini saya ada post artikel mengenai simpanan haji melalui Dinar Emas. Seperti mana kebiasaan kita menyimpan untuk kos mengerjakan haji selalu nya di Lembaga Tabung Haji. Memang betul ianya satu badan atau institusi untuk simpanan dan meyelenggarakan urusan haji bagi para jemaah di Malaysia.

Baru-baru ini saya ada post artikel mengenai simpanan haji melalui Dinar Emas. Seperti mana kebiasaan kita menyimpan untuk kos mengerjakan haji selalu nya di Lembaga Tabung Haji. Memang betul ianya satu badan atau institusi untuk simpanan dan meyelenggarakan urusan haji bagi para jemaah di Malaysia.

By Luke Burgess | Tuesday, June 14th, 2011

As the world's top gold producer and

second largest consumer, China is the single most important player in the global gold arena.

Last year, Chinese gold demand grew by

32% — reaching nearly 25,000,000 ounces for the first time in

history. Yet despite the country's seemingly insatiable appetite for the

yellow metal today, world leaders are concerned the demand for gold

could get

out of hand...

Adam Sharp - Tuesday, June 14th, 2011

Standard Chartered just released a 64-page outlook for gold, and the bulls will be pleased with its findings. Its authors say $5,000 gold is likely in the near future.

The report highlights a worldwide lack of new production and increasing demand from Asia. More from CNBC:

Standard Chartered just released a 64-page outlook for gold, and the bulls will be pleased with its findings. Its authors say $5,000 gold is likely in the near future.

The report highlights a worldwide lack of new production and increasing demand from Asia. More from CNBC:

In an otherwise quiet article about central banks today, Bloomberg

quoted an analyst who says China may use up to a third of their $3

trillion in foreign reserves to purchase gold.

China has been moving away from the dollar, and into alternative stores of wealth for years now.

But $1 trillion into gold? If it happens, such a large move would further threaten the dollar's status as reserve currency. It would also provide further buying pressure in gold for years to come (as the dollar crumples into a pitiful heap on the floor).

China has been moving away from the dollar, and into alternative stores of wealth for years now.

But $1 trillion into gold? If it happens, such a large move would further threaten the dollar's status as reserve currency. It would also provide further buying pressure in gold for years to come (as the dollar crumples into a pitiful heap on the floor).

Sunday, 19 June 2011

By Indo Asian News Service | IANS – Fri, Jun 17, 2011

Hyderabad,

June 17 (IANS) Around Rs.12 crore in cash and nearly 100 kg of gold

were found from Yajur Mandir, the personal chamber of late spiritual

guru Sathya Sai Baba, at Prashanti Nilayam in Puttaparthi of Anantapur

district, a trust official said.

Kesohoran dinar sebagai satu matawang rasmi dalam sektor ekonomi sudah

lama tersemat dalam lembaran sejarah Tamadun Islam. Dewasa ini komoditi

ini seringkali dicanangkan sebagai instrumen alternatif dalam aktiviti

ekonomi dunia semasa. Fakta ini adalah berasaskan kepada nilai intrinsik

atau tersendiri yang diyakini boleh digunapakai secara lebih meluas

serta konsisten. Namun demikian, masih ramai belum mengetahui dari mana

dan bagaimana ia boleh berkembang sehingga menjadi satu matawang utama

dalam kronologi ketamadunan Islam.

Penggunaan dinar emas menggantikan mata wang dalam sistem perniagaan dapat membantu mengurangkan kesan akibat krisis kewangan yang berlaku sekarang.

Naib Canselor Universiti Malaya (UM), Profesor Datuk Dr. Ghauth Jasmon berkata, penggunaan dinar emas adalah praktikal ketika ini memandangkan nilai emas yang sentiasa meningkat.

WANG dan sistem kewangan banyak berkaitan dengan penghasilan kekayaan.

Malah, ramai beranggapan wang itu sendiri adalah kekayaan. Dalam hal

ini, institusi kewangan memainkan peranan penting.

Institusi kewangan berperanan memobilisi simpanan sedia ada serta menyalurkan kepada pelabur supaya dapat digandakan untuk kekayaan dan penghasilan modal. Peranan dimainkan institusi kewangan ini tidak boleh dipandang remeh.

Institusi kewangan berperanan memobilisi simpanan sedia ada serta menyalurkan kepada pelabur supaya dapat digandakan untuk kekayaan dan penghasilan modal. Peranan dimainkan institusi kewangan ini tidak boleh dipandang remeh.

Saturday, 18 June 2011

(Kitco News) - How the situation in Greece unfolds

over the coming days could influence the precious metals market into

next week, market participants said Friday.

As Greece teeters on the brink of default and civil unrest rises in the country over sharp spending cuts, gold has seen some safe-haven buying emerge as investors flee riskier assets.

As Greece teeters on the brink of default and civil unrest rises in the country over sharp spending cuts, gold has seen some safe-haven buying emerge as investors flee riskier assets.

Thursday, 16 June 2011

Diciptakannya emas dan perak oleh Allah menurut Imam Ghazali adalah

agar emas dan perak ini digunakan sebagai hakim atau timbangan yang adil

untuk menilai barang-barang dalam bermuamalah. Hal ini sejalan dengan

banyaknya ayat-ayat al-Quran yang memerintahkan kita untuk menegakkan

timbangan atau neraca yang berarti juga menegakkan keadilan.

http://www.jsmineset.com/While

stock markets and other asset classes getting mauled, real money, gold

and silver, are attempting to hold their ground, today King World News

interviewed legendary Jim Sinclair. When asked about the action

Sinclair stated, “Well I think the gold market today is acting

extraordinarily well being on the positive side when every other asset

that people can find are being thrown out the window, especially in the

equity markets...Where gold is concerned you are dealing with the

condition of the international banks, with the balance sheets of the

financial entities of the world.

Tuesday, 14 June 2011

San Antonio, Texas-- (Kitco News) Gold should trade

to just over $1,600 an ounce by the end of 2011 and silver should be

flirting with $50 an ounce as governments will need to maintain a loose

monetary policy despite the phasing out of stimulus packages in the

U.S., according to the director of a major research firm.

Philip Newman, research director of GFMS, said in an interview on the sidelines of the International Precious Metals Institute’s Precious Metals Conference here there may be too much focus in the markets on the second quantitative easing versus a possible third program.

Philip Newman, research director of GFMS, said in an interview on the sidelines of the International Precious Metals Institute’s Precious Metals Conference here there may be too much focus in the markets on the second quantitative easing versus a possible third program.

Assalamualaikum dan Salam Sejahtera para pembaca semua.

Apa khabar ?

Diharap anda sihat sentiasa dan ceria.

Pada januari 31,2011 lalu, saya memantau harga emas. Apa akan

jadi agaknya kalau harga emas terus turun?

Adakah mereka yang melabur dalam emas akan kehilangan

sebahagian besar nilai pelaburan mereka?

jadi agaknya kalau harga emas terus turun?

Adakah mereka yang melabur dalam emas akan kehilangan

sebahagian besar nilai pelaburan mereka?

The World Gold Council is committed to the development of a truly sustainable gold mining industry.

Mining has broad social and economic benefits for developing and developed countries alike. Responsibly produced gold contributes to the economic and social development of local communities whilst providing important national revenue for countries with gold reserves.

Mining has broad social and economic benefits for developing and developed countries alike. Responsibly produced gold contributes to the economic and social development of local communities whilst providing important national revenue for countries with gold reserves.

The World Gold Council is the global authority on gold and its uses,

and the first source of informed opinion and advice for stakeholders and

decision makers. Our research provides authoritative analysis of key

aspects of the gold market. We provide comprehensive market

intelligence, helping to inform your strategic decisions. Our programmes

and market interventions provide unique insights and add value to our

partners and stakeholders across all sectors.

Research

The World Gold Council’s investment research programme provides

investors around the world with key information about the dynamics of

the gold market and about the investment properties of gold as an asset

class.

We publish a wide range of research papers looking at gold's investment characteristics. Our research examines gold’s special characteristics as a store of value, inflation and currency hedge, and portfolio diversifier.

We publish a wide range of research papers looking at gold's investment characteristics. Our research examines gold’s special characteristics as a store of value, inflation and currency hedge, and portfolio diversifier.

Research

The World Gold Council conducts research into the existing and emerging

technology related markets for gold. Technology related uses of gold in

industrial applications, including electronics, dentistry, medicine and

nanotechnology, account for around 12% of gold demand (an annual

average of over 434 tonnes from 2005 to 2009). Our market intelligence

and insights allow us to develop technologies and support markets in a

way that protects, strengthens and expands the role gold plays in

industrial applications.

Precious

metals prices dipped today as New York opened despite more evidence that

Greece likely to default (at least technically) and strong industrial

demand for silver.

Author: Julian Phillips

BENONI -

After a quiet and steady week, gold jumped in New York yesterday. In Asia, after New York's higher close at $1,540, the gold price was steady, which was surprising because it was in the face of a stronger dollar. The result was the gold in the euro jumped from below €1,049 to €1,064.

It was not until London opened that the gold price

started to move slightly up to $1,543. At London's morning Fix it was

set at $1,541.00 and in the euro at €1,064.45. Gold is still

consolidating.

By:EK

OPEC discussion on Wednesday led to another technical hick up. It centered on whether or not the current slip-up in global growth is a result of too high oil prices. The Saudi’s on one side kept saying that high prices are having an impact, and should be lowered to support the global economy, but Iran insisted the world is slowing down anyway and increasing output may lower prices below $80, damaging its ability to fund domestic projects.

OPEC discussion on Wednesday led to another technical hick up. It centered on whether or not the current slip-up in global growth is a result of too high oil prices. The Saudi’s on one side kept saying that high prices are having an impact, and should be lowered to support the global economy, but Iran insisted the world is slowing down anyway and increasing output may lower prices below $80, damaging its ability to fund domestic projects.

Monday, 13 June 2011

(Kitco News) - Comex gold futures prices are trading

steady to weaker and silver is lower in quieter early dealings, as

much of Europe is on holiday Monday. Lower crude oil prices are

modestly bearish for the precious metals markets to start the new

trading week. August gold last traded down $0.80 an ounce at $1,528.40.

Spot gold last traded down $4.80 an ounce at $1,527.75. July Comex

silver last traded down $0.697 at $35.63 an ounce.

Saturday, 11 June 2011

Emas Se Amas = 2.551 gm

Emas Se Rial =2.70 gm

Emas Se Kupang = 0.64 gm

Emas 2 Kupang = 1.28 gm ( Kupang Terengganu )

Emas 6 Suku ( sama dengan 1½ mayam ) = 5.06 gm

Emas 5 Busak ( sama dengan ½ Mayam ) = 1.69 gm

Emas 1 Mayam = 3.37 gm

Hina Besi kerana karat Mulia Emas kerana kilat

Emas Se Rial =2.70 gm

Emas Se Kupang = 0.64 gm

Emas 2 Kupang = 1.28 gm ( Kupang Terengganu )

Emas 6 Suku ( sama dengan 1½ mayam ) = 5.06 gm

Emas 5 Busak ( sama dengan ½ Mayam ) = 1.69 gm

Emas 1 Mayam = 3.37 gm

Hina Besi kerana karat Mulia Emas kerana kilat

Subscribe to:

Comments (Atom)

Post Catagories

- Agama / Hukum-Hakam (1)

- Aktiviti (5)

- Gold Saving / Investment (106)

- Simpanan / Pelaburan Emas (40)

- Ucapan / Wish (6)

- Zakat (2)

HIJRAH DINAR PRICE

HIJRAH SILVER PRICE

KITCO SPOT PRICE

MALAYSIAN SPOT PRICE

Shout Box

About Me

Followers

Powered by Blogger.